AMD Q4 FY12/24 Earnings Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

The Grass Actually Is Greener Over There

by Alex King, Cestrian Capital Research, Inc

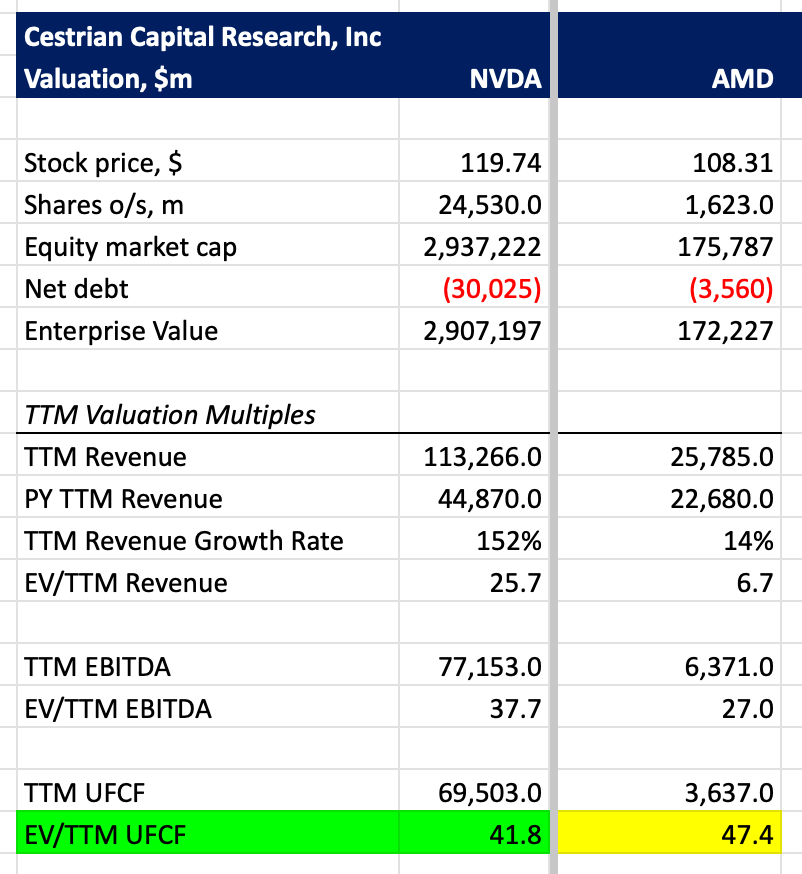

The whole problem with AMD is Nvidia, for three reasons.

One, NVDA has huge market share in datacenter and AMD does not.

Two, NVDA is growing at 150% on a TTM basis and AMD is not.

Three, NVDA stock costs less on a cashflow multiple basis.

At some point AMD stock may reach a technical low but that hasn’t happened yet.

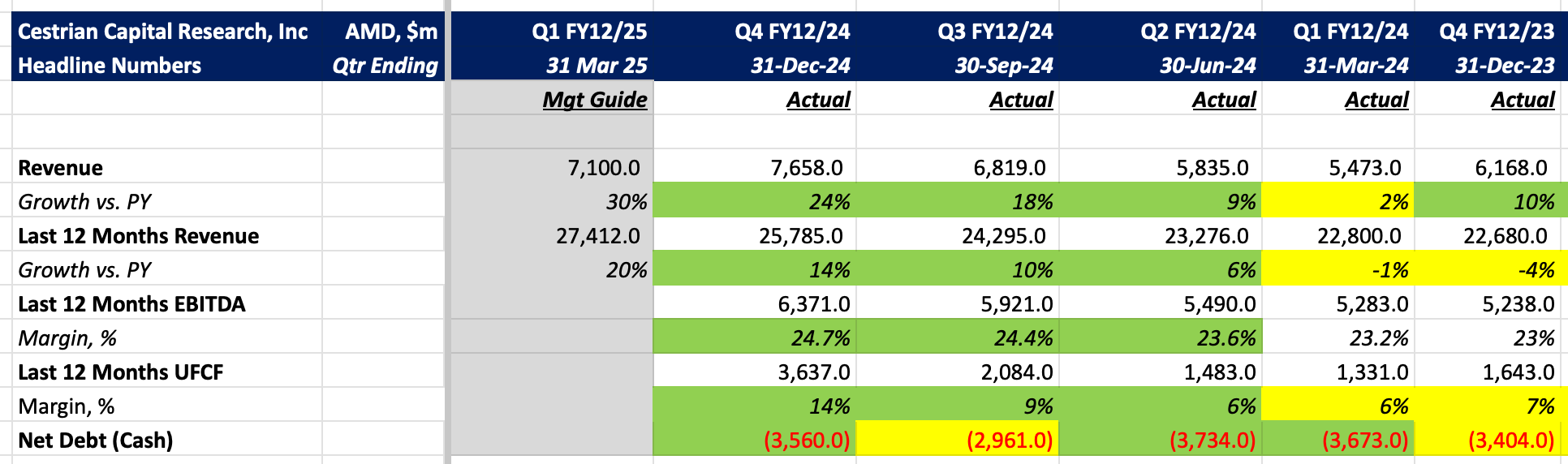

Here’s the summary fundamentals:

Let’s get on and look at how the stock behaves on its chart, and where it might be headed from here.