AMD Q3 FY12/24 Earnings Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitationof an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

The Problem With Runners-Up

by Alex King, CEO, Cestrian Capital Research, Inc.

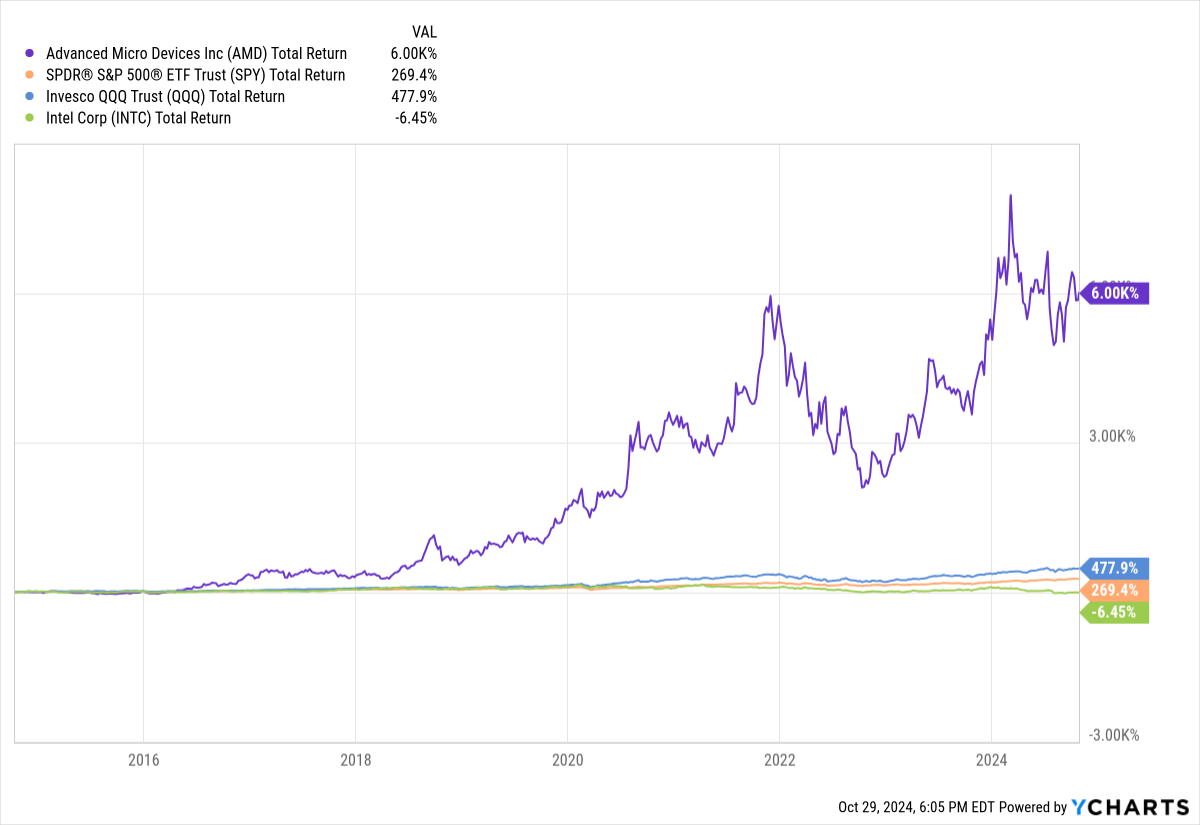

AMD CEO Lisa Su has delivered maybe the most value creation of any corporate turnaround in the history of ever. From her appointment as CEO to date, here's the total return (including re-invested dividends) of $AMD vs. $SPY vs. $QQQ vs. the original target of AMD's newfound energy, $INTC.

This has clearly been fantastic news for $AMD shareholders.

The trouble with tech is that, even more than other industries, it loves to find a monopoly winner and ride it for as long as possible. And if you were to add $NVDA to the chart above, you would find that it had returned something like 5-6x the value that AMD had over the period. Because it turns out that the real competitor was the other chip company in Santa Clara!

Being number two in an important category in tech is a great way to run a pretty good business, but it's a terrible way to run a great business. Because nobody truly needs you except to put price pressure on your bigger competitor. And this is AMD's problem in life. It's why in a ginormo AI boom, when NVDA can't produce units fast enough, AMD still has its stock price languishing somewhat and indeed dropped a little on today's earnings print.

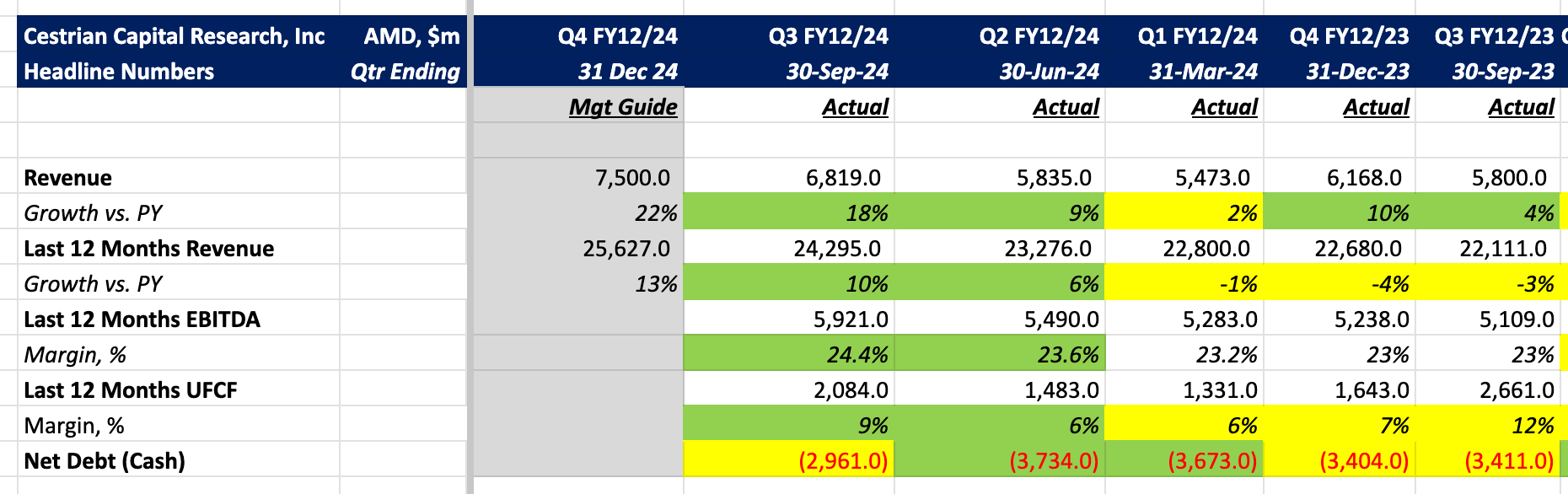

Here's the Q3 headlines:

Detailed nmbers, valuation and chart follow for all paying subscribers regardless of service tier.