Airbnb (ABNB) – Q4 FY12/2024 earnings review

- Airbnb ($ABNB) wrapped up FY12/2024 with Q4 revenue, nights booked, and Gross Booking Value all accelerating sequentially.

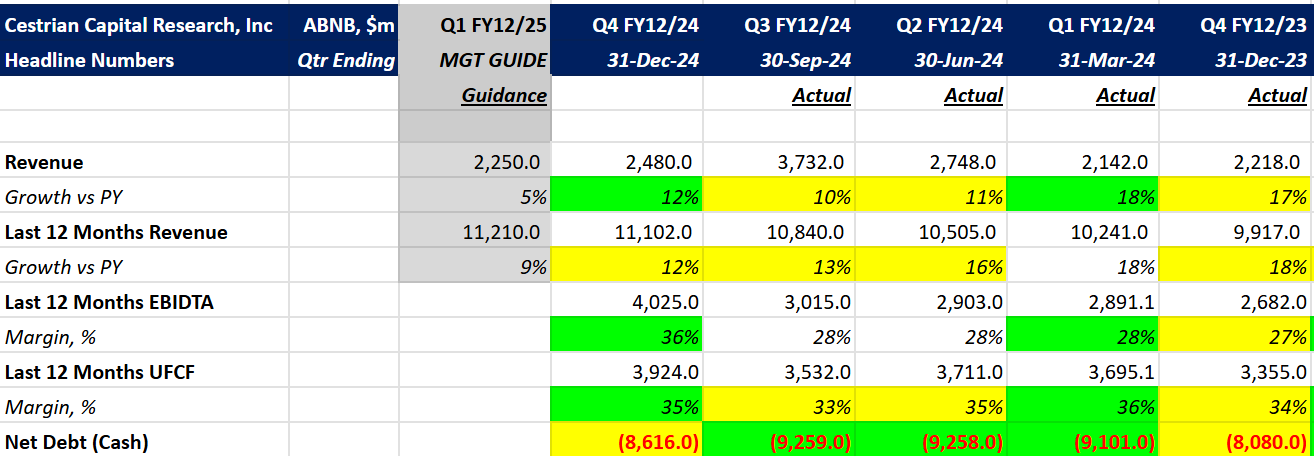

- Q4 revenue growth stood at 12% year-over-year (YoY), and EBIDTA and cash flow margins both increased.

- Strong balance sheet with $8.6 billion cash.

- Read on for detailed financials, technical analysis and our rating.

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

The Beginning of a New Airbnb ! ?? !

by Abhishek Singh (Abhisingh_86)

Airbnb ($ABNB) wrapped up FY12/2024 with Q4 revenue, nights booked, and Gross Booking Value (GBV) all accelerating sequentially. Revenue in Q4 grew 12% year-over-year (YoY), with both EBITDA and free cash flow margins expanding. The balance sheet remains strong, with $8.6 billion in cash.

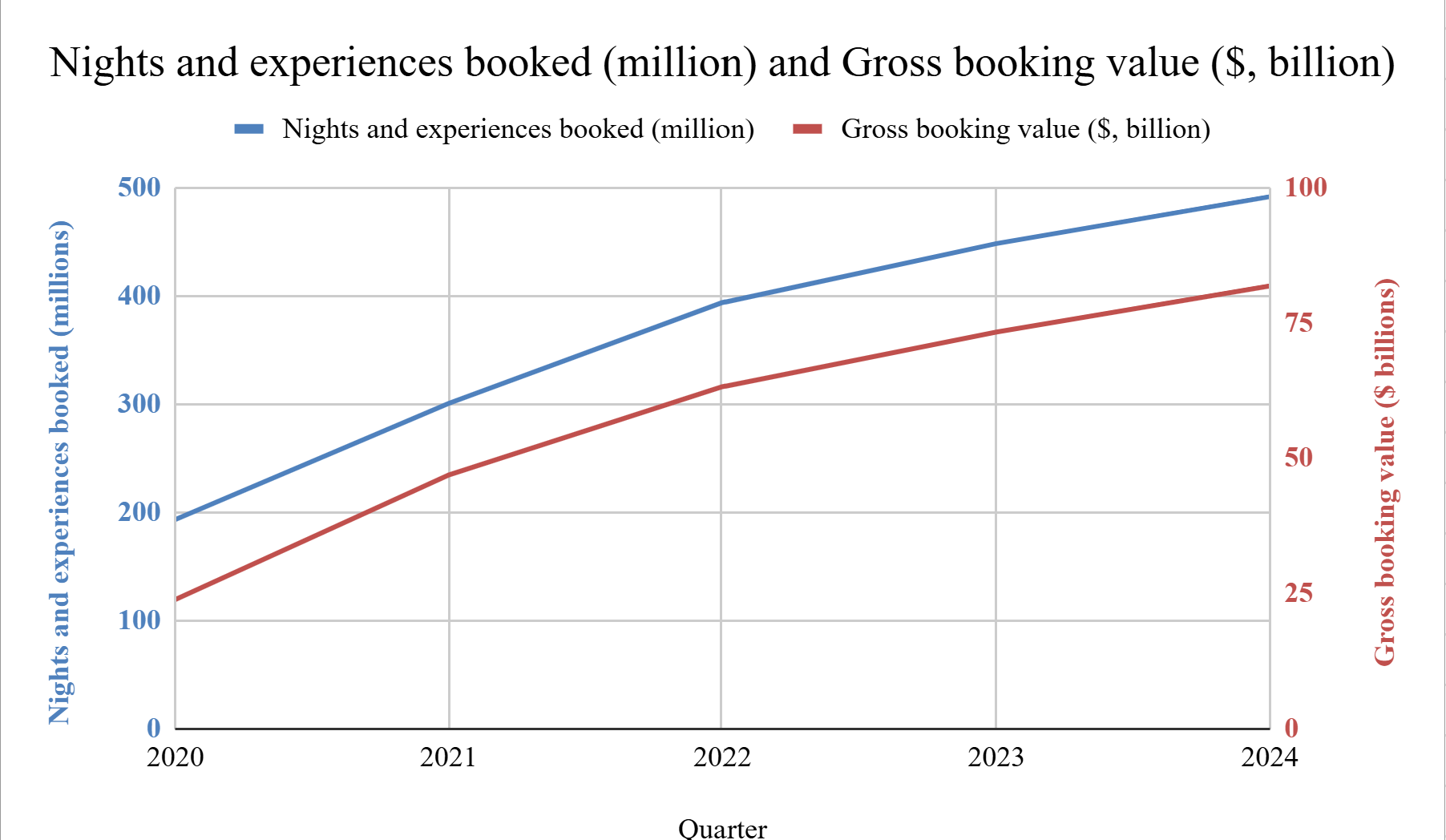

Non-GAAP metrics relevant to the online travel platform business—Nights and Experiences Booked and GBV—continued their upward trend.

The company has spent the last few years focused on perfecting its core service, which includes making hosting mainstream, improving affordability and reliability for hosts, and rolling out hundreds of product upgrades. In parallel, Airbnb has been pushing international expansion beyond its five core markets. Management had long signalled the eventual launch of new products and services, and in the latest earnings call they finally announced: “The next chapter” begins May 2025. A $200–250 million investment has been earmarked for launching and scaling these new offerings—an effort that will weigh on margins in the short term but is pivotal for the company’s long-term trajectory.