Airbnb ($ABNB) – Q2 FY12/2024 earnings review

Summary

- ABNB posted a decent Q2 FY12/2024; however, the TTM revenue growth declined to 16%.

- Management provided weak guidance for Q3 FY12/2024, attributed to slowing demand from US guests.

- The stock fell a solid 14% post-earnings and found support at, wait for it, the c-wave = 1.618 * a-wave level.

- Read on for detailed fundamental analysis, technical analysis, valuation, and rating.

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

It’s All About the R-Word

by Abhishek Singh

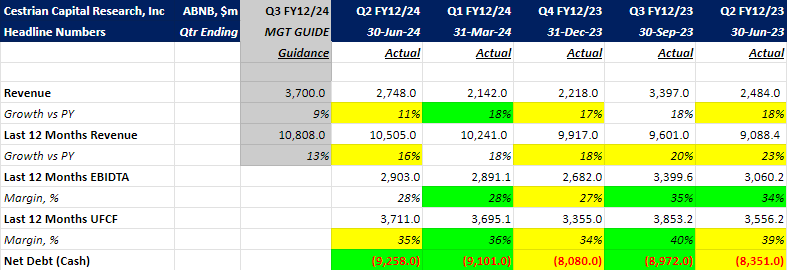

Airbnb ($ABNB) reported a decent Q2 FY12/2024, and the stock dropped 14% in after-hours trading. The stock has been meandering in the $115-120 price range for the last four weeks. Before diving into the details, here are the headline numbers:

- Revenue growth (quarter-over-quarter) slowed to 11%. TTM revenue growth also decelerated to 16%.

- Margins: EBITDA margins remained flat, while UFCF margins reduced by 100 basis points.

- Balance Sheet: The company maintains a net cash position of $9.3 billion.

Airbnb’s earnings calls and shareholder letter provide insights into key focus areas and initiatives, which could be classified as short-, medium-, and long-term growth drivers.

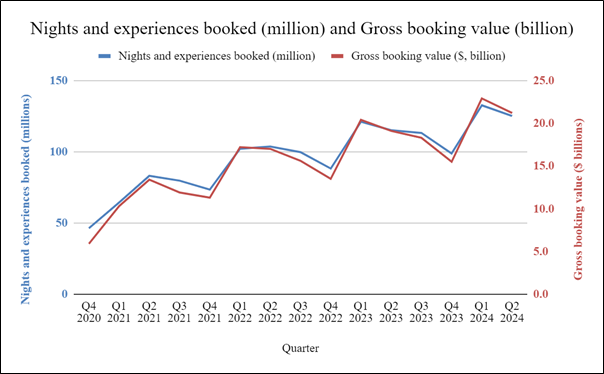

Non-GAAP measures relevant to the online travel platform business, such as nights and experiences booked and Gross Booking Value, continued their upward trend.

At face value, most fundamental analysis parameters appear stable—neither exceptional nor disastrous. So, what triggered the 14% post-earnings drop? To uncover the potential cause, let’s review two points mentioned in the pre-earnings review note:

It is crucial to see the TTM revenue growth rate decline halt and eventually reverse. Whether this occurs in the next quarter or several quarters down the line remains to be seen, but it is a key metric to monitor.

Robust summer travel demand will only be reflected in Q3 2024 numbers.

The latest earnings show that revenue growth continues to decline, but there’s nothing in the numbers indicating significant business performance issues.

One would expect robust summer travel demand to be reflected in the guidance for Q3 2024. However, management indicated a sequential moderation in the year-over-year growth of Nights and Experiences Booked relative to Q2 2024, citing signs of slowing demand from US guests due to macroeconomic pressures and shorter booking lead times globally (= R-word). Given the cyclical nature of the business, this was likely enough to cause investor jitters. The stock fell a solid 14% post-earnings and found support at, wait for it, the c-wave = 1.618 * a-wave level.

Below - available to paying subscribers of all tiers here - we review the fundamentals, the valuation, the stock chart, our rating. Read on.