Airbnb ($ABNB) – Pre-Earnings Check-In on This Online Travel Platform Giant

Summary

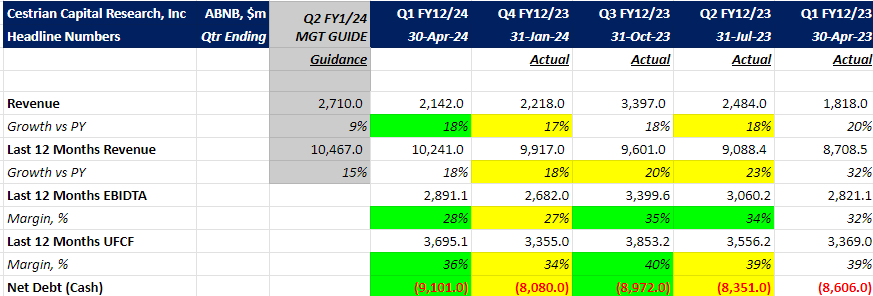

- ABNB posted a solid Q1 FY12/2024, with TTM revenue growth steady at 18%. Both EBITDA and UFCF margins increased.

- The company has a strong balance sheet with a net cash position of $9.1 billion.

- Summer travel rush revenues will not be reflected in the upcoming Q2 FY12/2024 results.

- Technical analysis indicates a potential a-b-c correction might be underway.

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Fundamentals vs. Technicals , Round ‘n’: Who Will Win on August 06?

by Abhishek Singh (Abhisingh_86)

Before addressing the headline question, let's review ABNB's recent performance:

- Revenue: Slight increase compared to the prior year quarter, with TTM revenue growth flat.

- Margins: Both EBITDA and UFCF margins improved.

- Balance Sheet: Net cash position of $9.1 billion.

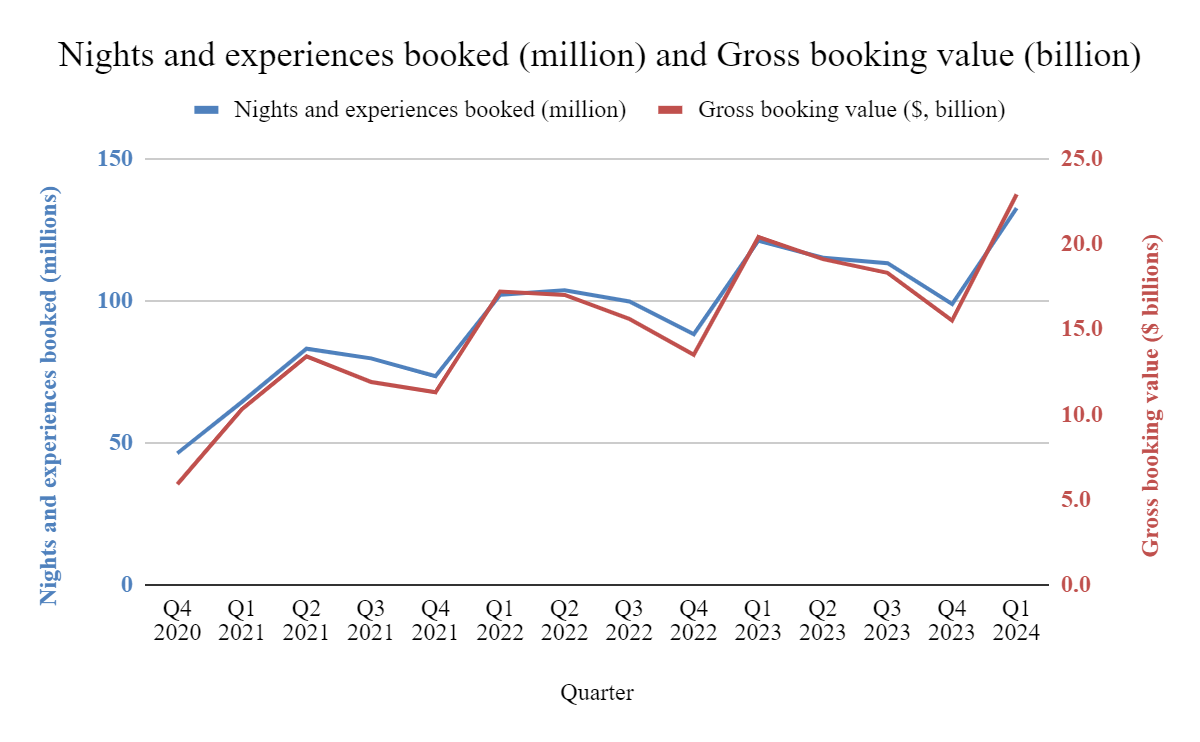

Non-GAAP measures relevant to the online travel platform business, such as nights and experiences booked and Gross Booking Value, continued their upward trend.

While the numbers seem solid, a key concern is the decelerating TTM revenue growth rate. Why focus on TTM numbers? Because the travel industry's seasonality can cause significant quarterly fluctuations for ABNB. Therefore, it is better to look at the slow-burn TTM indicators. Based on management guidance, the TTM revenue growth rate is expected to decline from 18% in the previous quarter to 15% in the current quarter. Management cites headwinds such as the timing of the Easter holiday, the inclusion of Leap Day in Q1 2024, and FX rate changes. Robust summer travel demand will only be reflected in Q3 2024 numbers.

It is crucial to see the TTM revenue growth rate decline halt and eventually reverse. Whether this occurs in the next quarter or several quarters down the line remains to be seen, but it is a key metric to monitor.

Paying subscribers, scroll down for our rating, fundamental and technical analysis. Yet to join us as a paying subscriber? Choose your tier from the links below. If it's Inner Circle you're interested in, join up in July - prices rise 1 August.