AI-Driven Sector Rotation

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

My Robot Buddy

by Alex King, CEO, Cestrian Capital Research, Inc

Today we introduce AI-driven sector rotation analysis to our RIA Insight Pro service.

This service is designed specifically for Registered Investment Advisers but can, of course, be used by investors or advisers of all kinds.

The basis of our RIA service is to help you grow client assets under management by using only simple equity instruments. Specifically we believe that prudent use of index ETFs such as SPY, QQQ and DIA (the S&P500, the Nasdaq-100 and the Dow Jones respectively), together with sector-specific ETFs such as XLK, SOXX, XLE (tech, semiconductor, energy), can help you outperform the market without taking undue single-stock risks or without undue structural risk by way of leverage, derivatives, and so on.

I’m delighted to welcome Jay Urbain, Ph.D to the team delivering this service. Jay’s background is data- and computer science; he puts his research to practical use in medical imaging and analysis, in Professorial teaching duties, and of critical importance to us, securities analysis. Jay treats securities pricing as a statistical problem; how can the price in an hour, or a day, or a week, be predicted on the basis of past price behavior? At its heart this is the same framework used by pure quantitative investment firms, of which Renaissance Technologies is probably the best known. (You can read about them here if you’ve yet to do so).

Jay operates a number of discrete subscription services on the Cestrian platform - specifically:

Each of these services generates consistently successful investment ideas and have seen tremendous subscriber growth - the SignalFlow AI service in particular.

SignalFlow AI is based on a proprietary model which employs machine learning techniques to work out whether it thinks the S&P500 or the Nasdaq is likely to encounter weakness ahead. If the model believes weakness is due, it signals risk-off (meaning, the model thinks investors should take their capital out of harm’s way). If the model believes all is well in the market it is studying, it signals risk-on (meaning, the model thinks investors should remain invested in that market). It is a wonderfully simple service which belies the complexity that lies beneath. I am a very happy user of this service personally. The model provides superb back-tested results and since the service has been running on live data the model has performed with a calm and correct approach to markets and has not been blindsided by the recent volatility - unlike most human market participants!

In the RIA service we will now apply this model to a sector ETF investing strategy.

To begin with we will operate this as a very simple model portfolio, along these lines:

Step One - Risk On Or Risk Off?

- If the model believes that the S&P500 is heading for trouble, it will signal “risk off” which means the model believes that capital should be withdrawn from the market.

- If the model believes the S&P500 is in good health, it will signal “risk on” meaning it believes capital should remain invested.

Step Two - If Risk On, Where Should Capital Be Placed?

- Within the sector rotation framework, where we currently analyze 10+ sector ETFs, the model decides which three of these ETFs it believes has the highest relative strength vs. the S&P500; and proposes capital be placed in those ETFs. If there are not three ETFs that meet the criteria, the model proposes the balance be invested in the SPY S&P500 ETF.

- The model rebalances daily at the close. If the model goes risk-off, it removes capital from the market. If the model remain risk-on, it may rebalance capital out of one ETF and into another. If you elect to follow the model you may choose to do the same, whether by placing buy / sell orders in post-market hours or at the open the following day. Thus far the model tends to not be particularly jumpy; it does not ‘overtrade’. So we do not anticipate that it will be a particularly difficult model to follow.

RIA Insight Pro subscribers will be invited to join a private Slack channel which will deliver the model outputs each trading day together with very simple explanations of what the model believes.

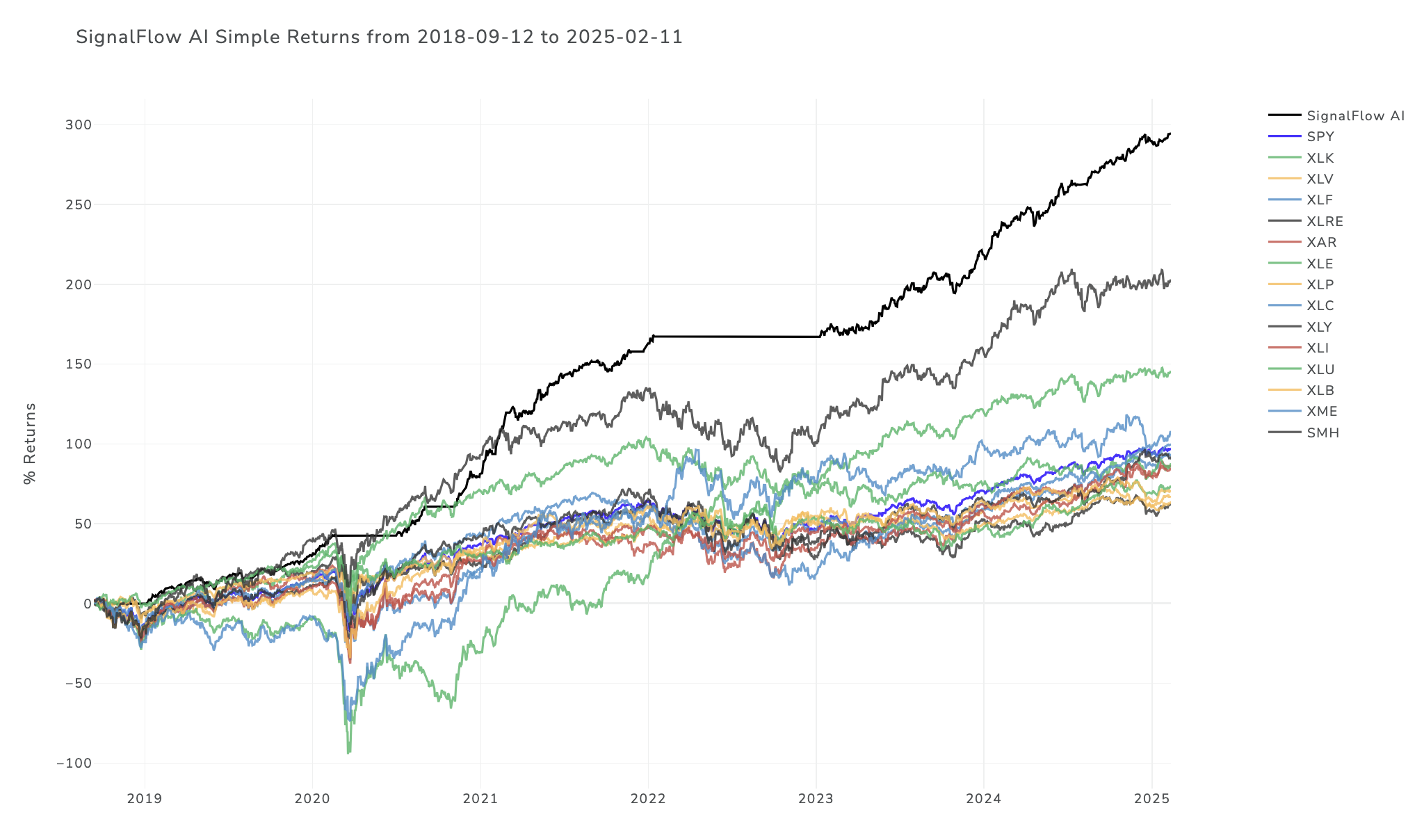

Now, we have backtested this approach and the results are below. I should emphasize that backtesting is backtesting; it is taking actual historical data and asking the model to imagine what it would have done if presented with that data. It is not the same as real-live operations. But as far as backtesting goes? The model looks good.

The line labelled “SignalFlow AI” is the back-tested result of running the above approach. Below we run the data from September 2018 to date; other periods also indicate significant outperformance.

All models have their limits, and no investment manager or adviser would typically let a model run unsupervised or ungoverned. So in our RIA Insight Pro service we will continue to do all our usual fundamental and technical analysis around the underlying stocks and ETFs and this will help us add a human dimension to the service. I will say though that I have learned to trust the SignalFlow model more and more as I see it navigate the present market volatility.

If you’re an existing RIA Insight Pro member, look for an email inviting you to join the new Slack RIA Model Output channel.

As always, any questions, reach out in either comments to this note, or using this contact form, or by email to minerva@cestriancapital.com.

Cestrian Capital Research, Inc - 13 February 2025.