Adobe Q4 FY11/24 Earnings Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Better Late Than Never

Well folks, I have sat on this report for awhile before posting it. And that is because I have been scratching my head a little as to what on earth is going on with Adobe stock. Most things of reasonable quality have been heading up but not, it seems, the San Jose Shape Changer, the Survivor Of The Desktop Publishing Era, The Company That Refuses To Die. The stock has been a mess all through 2024, dropping about a third of its value when the indices were reaching for the stars.

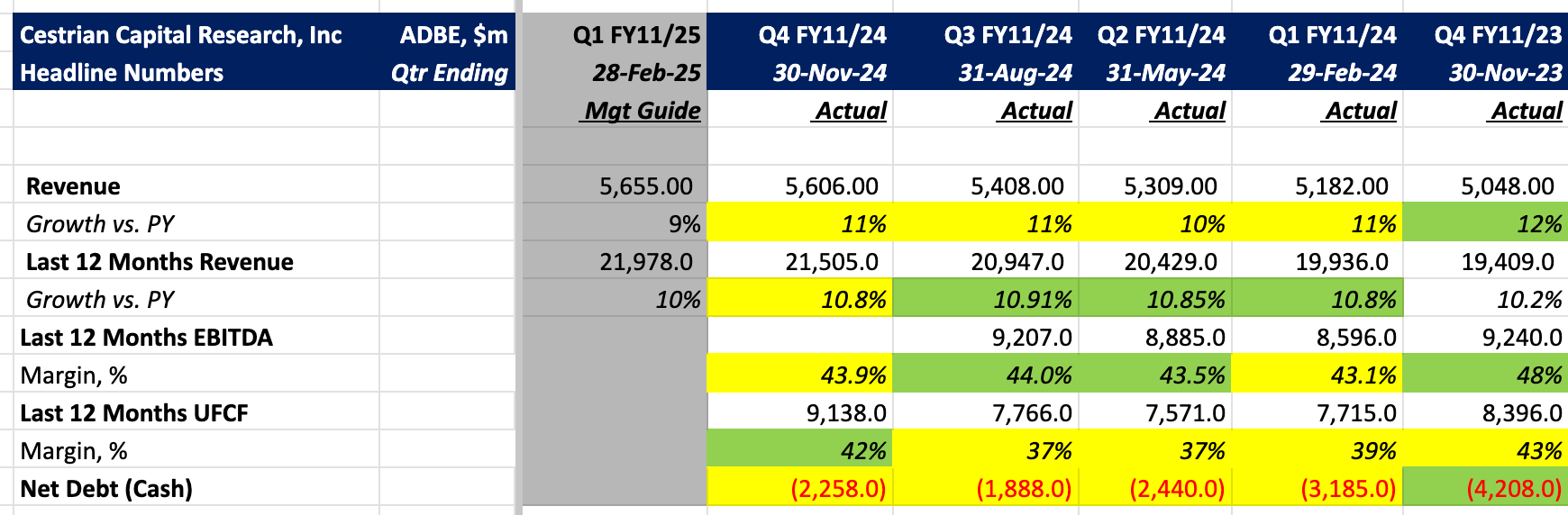

As usual you cannot explain price action by looking at the fundamentals. The numbers are fine.

And the valuation, as we shall see below, is also fine. Not expensive, not cheap.

The answer lies in the stock chart, I think. I believe ADBE stock to be at a useful position as regards trade entry.

Allow me to explain.