Adobe Q3 FY11/24 Earnings Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Another Hot Grandpa

by Alex King, CEO, Cestrian Capital Research, Inc.

Well, in a week when Oracle - Oracle! - set the prairie on fire with tales of rampant revenue growth from the revisionist cloud-denier, we might expect another Silicon Valley Old Timer to also clock in some good news. And Adobe did report a solid quarter, 'cept unlike the Grand Old Duke Of Redwood Shores, the CEO of this shape-shifting survivor did not seem to persuade the market of the same good cheer.

We think the stock can go up anyway though.

The numbers were good, the stock isn't expensive on fundamentals in my view, and the technical setup for the chart looks bullish.

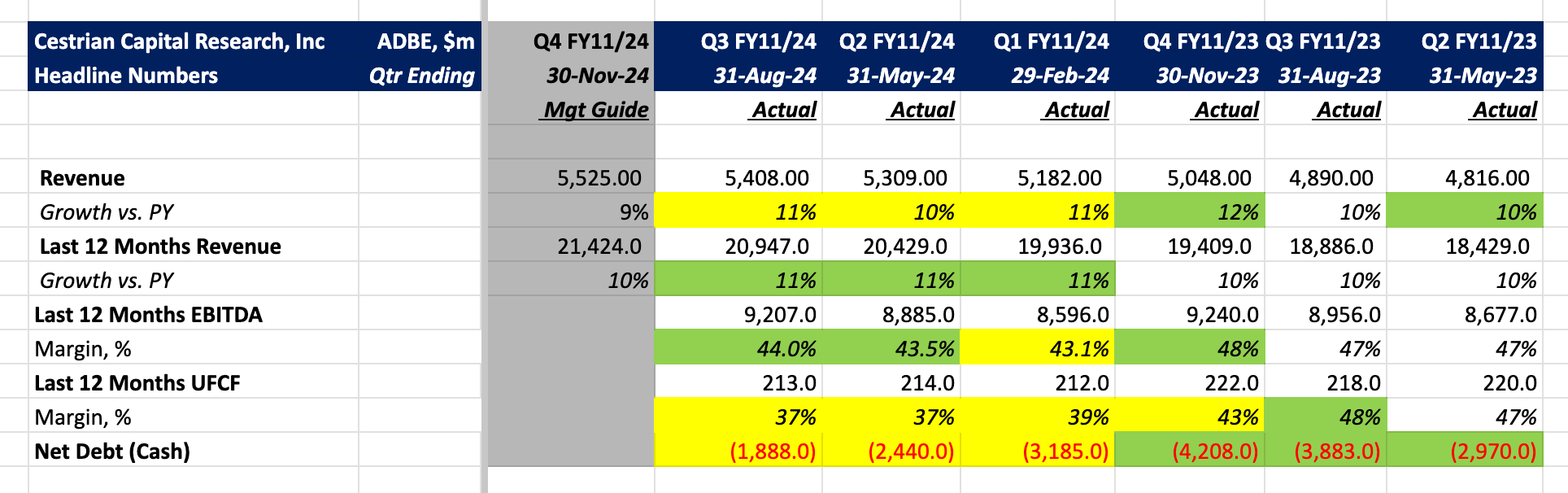

Here’s $ADBE headlines.

Read on for the financial detail, valuation, our stock chart and rating! Any paid subscription here gets you the full note.