Adobe Q2 FY11/24 Earnings Review

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

In The End It Needs More Than Compute

by Alex King, CEO, Cestrian Capital Research, Inc

Right now, everyone knows to buy $NVDA if they want to ride the AI train from here to the singularity. And everyone, unusually, is probably right - at least until they aren't. After 12-18 months of "it's all about AI" as a narrative to support buying tech stocks, we are now seeing some cracks in the facade with people having the temerity to ask "but where is the value from AI?" - "which companies not called Nvidia are growing faster or making more money because of AI", etc. I think at some point a Ben Hunt "Common Knowledge" moment may kick in when everyone is prepared to say to one another "gee that titanic pile of overheated GPU that is causing the electricity grid to groan under the load ... it is literally just hot air, there's nothing to this fad". In about 2000-2 it was Common Knowledge that the Internet was at best useless and at worst some kind of scam. Not only did everyone know that the Internet was useless with 56Kbps in the last mile and browsers incapable of maintaining a session long enough for you to fill in your address in an HTML form ... but suddenly everyone was prepared to say it was useless.

What happened then was, when everyone was telling each other that it was useless and a fad and a scam, the clever people quietly went to work and Made the Internet Great Again. So that by 2005 it was a great time to be quietly accumulating tech stocks; and by 2010 it was Common Knowledge that with the Coming Of Internet 2.0 (as it was actually called!), the Internet Was Now The Bomb.

I think AI will be like this. Big ole hype cycle right now; trough of disillusionment sooner rather than later. Then quietly your Demis Hassabis's of this world will be working away at the silicon face until ... BLAMMO your job is gone and you didn't even see it coming. On the plus side you will be able to subscribe to an AI Careers Coach Virtual Assistant, deliverable via bone conduction spectacles, for just 1 Jensen per day. You're never going to get a job again. But at least they will tell you how great you are.

The question is, which stocks not called Nvidia will benefit when the day comes? I think Adobe may be one of them, and that's because (1) Adobe does graphical content really, really well (2) Adobe has a long history of acquiring innovative companies who were previously focused on killing Adobe - Macromedia, anyone? (3) it may have been nixed by fun-hating G-men everywhere, but the Figma acquisition was a really good idea and it showed the company was happy to take its monopoly rents, sorry I mean monthly subscription fees, from SMBs everywhere, capitalize them and turn them into Crazy Big M&A Spending. This is wild stuff for what should be a boring ole Valley denizen, whose managers ought now to be mainly spending their days at the 19th hole, lying to each other about the old days.

Anyway. The quarter was pretty good, the valuation isn't offensive, and I think the stock may be setting up for a bullish move. Read on!

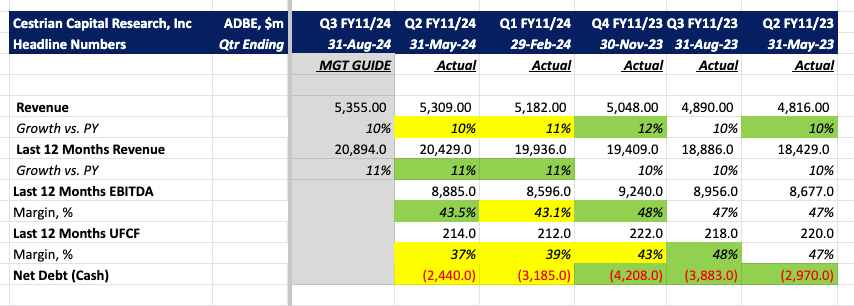

Headline Financials

Below - available to paying subscribers of all tiers here - we review the fundamentals, the valuation, the stock chart, our rating and price target. Read on folks.