24 Months In The Rabbithole, Or, How I Learned To Stop Worrying And Love 3x ETFs

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

A Few Things I Have Learned Along The Way

by Alex King

In Cestrian’s subscription services we put a lot of work into charting and measuring movements in the most liquid securities markets, being the S&P500, Nasdaq-100, Dow Jones, US Treasuries and a host of major sector ETFs. We do this not by top-down macro analysis or forecasting nor by bottom-up earnings analysis or forecasting. We measure and chart price and volume and try to apply pattern-recognition methods - aka. technical analysis - to form a view on where price may move next over the time periods in question.

Why?

Because this is the basis of hedged ETF trading, and hedged ETF trading has for me personally been an A-HA moment; and this took place a fairly long way into a professional investing career wherein I have been no slouch already.

I’m about two years into this particular game - hedged trading - and as you know, two years is nothing in terms of miles on the road in any particular investing or trading method. So whilst I consider myself no kind of veteran of the sport, it has been such a revelation for me that I see this work as core to the value we offer our subscribers at Cestrian. I hope that as a reader of our work you can take advantage of it. And with that in mind I thought it worth sharing a few lessons learned.

This is a no-paywall note. If you’re a paying subscriber of ours, I hope it will help you use our work still more effectively. If you’re not a paying subscriber of ours, I hope you find this note useful, and of course I hope even more that you will consider joining one of our pay services. You can learn more about our entry-level Market Insight service here, and our premium Inner Circle service here.

And if you just want to sign up for our free, before-the-paywall content? You can do that here:

So, back to the topic at hand, being hedged ETF trading.

In no particular order this is stuff I know now that I didn’t know 2 years ago.

1 - Forget Everything You Were Taught About Buy And Hold

There is a place for buy & hold. The smartest piece of financial advice I ever heard remains Mr Buffett’s throwaway remark about the S&P500. How, he was once asked, should the average person invest? His answer was, spend less than you earn, and every month put some of the money you have left over into a low-cost S&P500 tracker fund. And never sell. This, to my mind, is an excellent buy & hold strategy. The S&P is well diversified, whatever all the bleating about overconcentration in the Mag7 might say. The companies in it are blue-blue-blue-chip, so the securities they issue are safer than most. The index and its derived funds - $SPY, $VOO and myriad others - are highly liquid and can handle very small or very large accounts without problems. And whilst the S&P500 does get beat up every now and then, in all of history it has recovered if you just wait. You can’t buy, hold and wait if (1) you invested money you needed and/or (2) you bought time-bounded securities like options or futures and/or (3) you used leverage, be it at a security level (eg. a leveraged ETF) or an account level (eg. a margin account). But if you did what Mr Buffett suggested, for years, decades? In all of history, that has worked out very well.

This is the exact opposite of how to succeed at hedged ETF trading.

The basis of buy & hold the S&P500 is that in all of history, it goes up over time. So you need to have time for it to go up. And if you have that, all good so far.

The basis of hedged ETF trading is, you don’t need to know which direction the ETF is going to go.

I’ll get into more detail on this below.

2 - Nobody Wants To Hear This, But It Works Much Better In A Portfolio Margin Account

By all means stop reading right now.

Most sensible people don’t like using margin, because margin is stupid, because Margin Call. But margin calls only happen when you abuse margin or do stupid stuff with it like YOLO GME 0DTE calls. Is a mortgage stupid? Not if you treat it right. Not if you take out a mortgage you can handle even if you lost your job for 12 months. And also, not if you take out a mortgage that you could repay with cash you have on the side. So there are ways to make margin accounts less risky. Firstly is, consider not drawing all the margin capacity your broker offers you, because guess what, they aren’t doing that to help you. Secondly, consider only drawing margin that you can repay tomorrow using cash you have somewhere else. Because 2008 was a thing and could be a thing again one day.

A portfolio margin account, set up so that your broker treats hedged-pair ETFs as offsetting the risk, can be a powerful tool for hedged ETF trading. This kind of account is wonderful for the broker of course. Because if you own in equal parts a long S&P500 ETF and a short S&P500 ETF, then the broker’s credit risk on you is, er, nothing. Because if the market moves, you win with one hand but lose with the other. So whatever happens in the market, you don’t become any more of a liability for the broker than you were yesterday. But they get to charge you a boatload of interest even when their risk exposure is 0! Brilliant. Used wisely though, this is also a great facility for the hedged ETF trader, because it means you have an ‘accordion facility’ on hand. You’re heavily long with limited cash in the account, the market turns and you want to hedge? If you have a cash account, than you have to (1) sell some longs (2) wait for those sold longs to clear and the money arrive in your account and only then (3) buy the short hedges. By which time probably the market has changed again. Whereas if you are in the same situation with a portfolio margin account, you can hedge 1:1 to see if the market is going to reverse or it’s just a hiatus; then if it does reverse, you can overhedge - say 2:1 short:long - without having to sell the long. In a market like the S&P500 where if your timeframe is say 1-2yrs+ on the long side, you may not want to sell the long at all; you may want to hold the long, ride the short down, cash in the short at the lows, and use that free-money profit to buy additional long exposure at those lows. A portfolio margin account allows you to do all this; it will cost you the interest burden but if you are doing it right, that’s just a minor performance drag rather than anything ruinous.

I have tried long/short hedged ETF trading in a cash account - for real and paper-traded - and it is a lot harder than in a portfolio margin account. A lot harder. I am not saying it can’t be done but I am saying that the burdens above are real burdens and they do get in the way of performance, much more so in my experience than do the egregious interest payments made to your broker in a portfolio margin account.

3 - It Makes Complete Sense To Hold Both Long And Short Sides Of The Same Market At The Same Time. Yes It Does. No, Really.

If you think you can time markets perfectly then have at it. Own the long when they are going up, and the short when they are going down. You rock. Stop reading right now.

Now, I have seen 100+ apparently sensible people say there is no need to hedge because they can time the market. Well, that’s 100+ people with more genius than I have ever seen amongst Wall Street’s finest, and I include Messrs. Simons and Buffett in the latter camp. If neither Jim Simons nor Warren Buffett think they can time the market, then, why Brad MacGuyver from Milwaukee or Olivier Parnasse from Nantes (nb - names changed to protect the stupid) think they can do it is beyond me. Simons solved the problem by trading at very high frequency with no religion as to direction and Buffet solved the problem by stretching out the timeline so long - to perpetuity! - that in the end all the volatility would net to the upside, because population growth.

Markets have a dominant direction over a period of time. People are incapable of perfectly deducing which direction that will be ahead of time. Equities trend up over time but with plenty of downside corrections. So if you are long equities, you probably don’t want to sell on any given Monday, because taxes, and because of the all-new emotional and numerical commitment to buying back into the long side at some future point. When the market sells off, why not own a short hedge that can move into the money, be sold for gains, and those gains used to buy additional long exposure at a lower price than was available when the short hedge was purchased? And if you call the correction incorrectly - if in fact the market keeps going up - you can just sell the short hedge for a small loss and move on.

The key to this is:

4 - Have Multiple Timeframes In Your Mind All At The Same Time.

In a bull market, the long is the dominant side and selloffs in the long ETF can be indulged. The short is the countertrend side. Short profits in a bull market are ephemeral and should be treated as such. One can, and in my view should, treat short profits in a bull market as free money to be banked whenever available. You can always re-enter a short hedge if the market keeps going down. But holding a short too long in a bull market will just eat your long profits or, if you are overhedged-short in a bull market, will actually cost you money when your regular retiree is making plenty of money whilst spending 0 time looking at charts and all their time quaffing sundowners at the 19th hole.

In a bear market, the above is reversed. Short is the dominant side and can be indulged. Long is the countertrend and profits are ephemeral, to be taken when available.

Bull market? Buy the dip. And when you analysis tells you a short-term top is in, wind on a short hedge, probably not all at once. Release the hedge to cash gains when you can. Don’t overstay your welcome on the short side. If you have short gains, use them to, yes, buy the dip. Rinse and repeat.

Bear market? Sell the rip. And when your analysis tells you the selling has peaked and a short-term reversal is happening, buy the dip - meaning, hedge long. Release the hedge - sell the rip - when your analysis tells you this short-term countertrend up-move is peaking. Don’t overstay your welcome on the long side. Use the long profits to add to shorts. Rinse and repeat.

5 - How To Know When A Market Is Changing Direction

Of course this is a core skill. The short answer is, learn to chart. Yup, it’s not easy. But if it was easy, anyone could do it.

Personally I like the Elliott Wave / Fibonacci method because it allows me to measure price movement relative to the recent price movements, independently of any other input. That is the kind of bizzaroworld system that securities markets are based on. (It’s not about earnings or rates or anything else when it comes right down to it). As a rule I love bizzaroworld, because usually it makes a lot more sense to me than the ex-post-fact0 garbage that people come up with to explain the world. And financial markets are a microcosm of that. Why did price go up? Because it had gone down so much already, scared everyone into selling, so of course bigs are going to drag it up again. Why did price go down? Because everyone had gotten bullish and was buying everything in sight so yippee go bigs, unloading their positions and then selling hard to freak out the poors. This, this, is how financial markets work. Rates LMAO.

The best part about hedged ETF trading though is, it doesn’t matter if you get it wrong. All that matters is that you recognize when you have got it wrong and then you act on it. Thought it was going up and it doesn’t? Hedge 1:1. Time is thus suspended. (Another reason to not use options). Starts going down? Overhedge short 2:1. Stops going down? Sell some short, release gains, go back to 1:1. And so on.

Hedged trading requires you to leave your opinion at the door. Forget your investment thesis. You have no thesis. There is only price, and you are a price follower, so, follow it.

6 - How To Improve Your Trading Performance

Simple really - want to get better at any sport? Play it a lot. Practice. Think about it a lot. Think about what you do well naturally, and badly naturally. Try to position yourself in a game where your natural skills help you and you don’t have to deal with your natural weaknesses too much. I personally have not found any reliable way of predicting the time period over which price changes may happen, so I don’t use time-bounded securities.

Any athlete who excels at their chosen sport is likely to be a pretty dull individual most of the time. Because they are always practicing that swing, that kick, that throw, that catch, that jump, that corner, either in reality or in their mind when they should be focused on what they’re going to have for lunch or what they’re doing next week. But they aren’t thinking about sandwiches or vacations, because they’re thinking about, what if I overbalanced a little into the ball next time? If I used the other set of tyres would I get more grip into that bend, and if I did, would it hurt me on the next bend, and if it did, is that worth it overall? And I think this is how you have to approach hedged trading. It’s not a part-time occupation. I personally am constantly looking at things like, is it really the case that if a Wave (ii) stops at an .886 retrace, is that a Wave (ii) or was it just a re-test of the trade point zero before the Wave (i) started, and if so, am I now in a Wave (iii) up, really, or in fact a Wave (i)? And stuff like that. This is actually what I think about all day. And I think this is a necessary part of the craft. I am also always thinking about, OK, if I were a market big and some idiot with a Discord was telling everyone about Wave 5 RSI divergences, what new wheeze would I come up with to bamboozle the Discordants in order to take their money right when they thought they had found Wall Street’s Secret Language? And so on. It’s not a quiet life, trading, even if most of the time I find myself in deep silence.

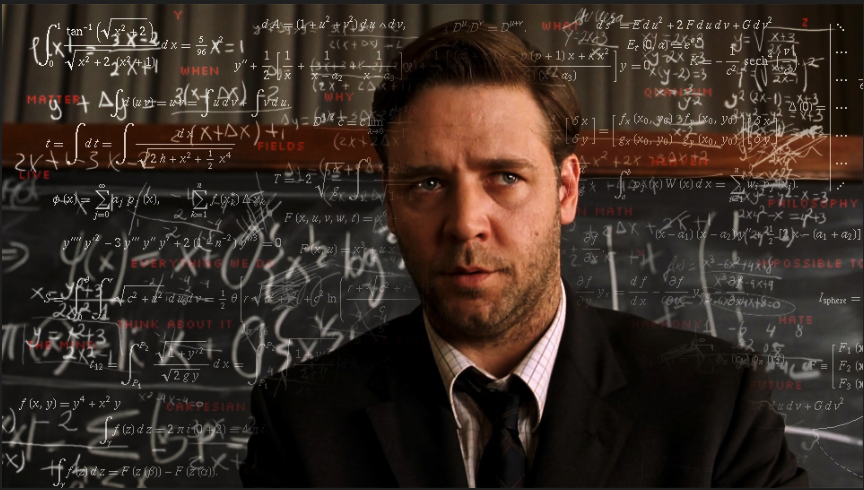

7 - How To Not Become Insane

Given (6) above this last point is important. So, here’s some ideas as to how not to succumb to Beautiful Mind syndrome.

Shut down a couple hours after the market closes.

Get at least one dog that requires a lot of exercise, feeding, grooming etc. Your dog doesn’t care about Fibonacci levels and it doesn’t care about market hours. (One of my dogs insists on going outside at precisely the moment one of the big stocks we cover is about to release earnings. And I mean to within about 30 seconds of the print).

Have outside interests. (Watching other people’s trading videos doesn’t count).

Sleep at least 7 hours/night. Jeff Bezos does it, so can you. (This one was a hard one for me to come to terms with, but once I did, my trading improved).

Walk a lot.

Whenever you think “I got this, wow I’m good”? Get ready to hedge. Because you don’t got this. Nobody got this. That’s the whole point.

Any questions, reach out! You can use this contact form if you’re not an Inner Circle subscriber, or you can use Slack chat as always if you are.

Cestrian Capital Research, Inc - 6 June 2024

DISCLOSURE - Cestrian Capital Research, Inc staff personal accounts hold long positions in, inter alia, $UPRO.