2025

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Time To Apply Some Skills

by Alex King, CEO, Cestrian Capital Research, Inc.

I have a rather queasy feeling about 2025.

I don’t think it’s going to be 2022 (relentless selling and extinguishment of any bullishness after any brief countertrend rally, induced by the Fed’s too-much-too-late rate hike cycle).

I don’t think it’s going to be 2008 (widespread opinion, not entirely irrational, that markets may pull a 1929 because of extensive overleverage of overvalued assets. solved only by a new and rather egregious method of transferring wealth from labor to capital that continues to this day, this being ‘quantitative easing’, otherwise known as ‘let us eat caviar whilst the poors can’t afford eggs’).

I don’t think it’s going to be 2000 (sector-specific collapse in equity valuations and high yield bonds, with a spillover to indices).

I think we already had 1987’s Black Monday, being 2024’s Yenmageddon in August.

Is it going to be 1929? Well, I’m old but not that old so I don’t have any kind of lived memory of quite what a Wonderful Life that was. Certainly markets and government have gotten a lot cuter since than about how to support price whenever investors try to self-harm in such a way. I refer you to the genius invention of QE. So, no, I don’t think it’s going to be 1929.

What I do think 2025 is going to be is, tricky.

In the second half of 2022 anyone with an ounce of emotion about markets had been thoroughly convinced that the bear market was going to continue. With SPX dancing around 3500, plenty of market commentators believed - genuinely believed, I think, that SPX2200, the Covid-crisis floor, was going to be revisited. Large swathes of investors held similar views, and this was the backdrop for an almighty bull market to commence. If you look closely, the SPX stopped falling in around April-May 2022 and then entered a sideways rangebound accumulation pattern, putting in a final spike low in October of that year before then setting course for the moon. I’m proud of the work we did here at Cestrian in calling the end of the bear and then making aggressive “buy” calls on scores of stocks and ETFs. That worked out very, very well. We held our untrammeled bull thesis through dips in Q1 2023, Q3 2023, Q2 2024; got briefly spooked by the above Yenmageddon in August 2024 before returning to straight-up bullishness soon afterwards. (Nothing a little overhedging couldn’t deal with!).

If you read our Market On Open series of notes (these) you’ll know that our house view remains net bullish on equity indices, subject to a couple of key levels that I think the S&P500 and the Nasdaq-100 have to first overcome if they are to keep climbing. That bullishness does not come with the same conviction I held in late 2022 / early 2023. I think the “buy anything sensible and go play golf” strategy - which beat most smart money by the way - of 2023-4 won’t play well in 2025.

This isn’t any kind of unique opinion; plenty of the commentariat are in the process of declaring 2025 a “stock-picker’s market” or a “trader’s market”. But what does that mean? I think it means “we haven’t a clue whether markets are going to rise or fall in 2025 so we will duck the question by saying that maybe some clever people will do well but passive buy and hold won’t”.

Speaking as someone who stock-picks and trades for a living I’ll tell you what I plan to do with my own capital. I would not presume to tell you what to do with yours, since we don’t at this time run anyone’s money and we don’t provide advice to anyone running their own. But here’s my personal plan for 2025.

- Maintain a small number of positions.

If one is uncertain about market direction it pays to have fewer things to worry about. If you believe a general bull market is on foot, you can own lots of things in the expectation they will go up. If you are bearish in general, you can be short lots of things with the expectation that they will fall and that you will benefit from this. A unidirectional view on markets is often correct. You just have to have the right direction in mind. I would not try to dissuade anyone who has a hard bull or bear thesis; either of these views may prove correct, I don’t know. I personally don’t have a fixed thesis going into the year so I don’t want to have capital pointing very simply up or very simply down, and in particular I don’t want to have to worry about a large number of single-stock names, each of which moves to its own rhythm as well as in time to that of the market at large.

I cut down a lot on single-stock names in the later stages of 2024. I’m happy I did so, partly because it meant cashing out gains, partly because it meant fewer moving parts to worry about.

- Trade technicals in preference to fundamentals

In my opinion, fundamental analysis is helpful when buying at the lows. If a wonderful business like Meta Platforms has its stock on sale at 7x trailing twelve month cashflows - as it did in late 2022 - then that’s in and of itself a great basis to think about buying the stock. Fundamental analysis is not, in my view, a great way to determine when to sell at the highs. Valuation multiples can continue to rise way past your ability to justify owning stocks at those multiples. Selling at the highs is best determined by stock charts. How extended a move has the name put in vs. its own history, within the overall analysis framework of your choice (for us, Elliott Wave patterns / Fibonacci measurements)? If you sell now and the stock continues to move up, can you live with it? If you don’t sell now, and the stock dives, can you live with that? These are my preferred methods to deciding when to sell. When markets are at extreme lows, I believe fundamental analysis is of great help. When at extreme highs, technicals reign supreme. I don’t think we are at extreme highs right now, but we clearly aren’t at the lows, so for me I pay a lot more attention to charts than I do EV/TTM UFCF multiples or anything of that ilk.

- Favor index and sector ETFs over single-name stocks

Nothing wrong with buying and selling single-name stocks if you have a thoroughly justified view on why you think they are going to go up (if long) or down (if short). I think in this environment it’s hard to have 20-30 theses on the boil at any one time. More than 10 single stock names I think is hard to wrap one’s mind around in any kind of volatile environment. I also think it’s wise to use “bracket orders” ie. when you enter a position, have your sell-stops (if long) and buy-stops (if short) set up right away (in each case I mean two limit orders, one preventing a big loss and one locking in realized gains). , and don’t tinker with them unless there is a very good reason to do so.

Personally I am more at ease owning index ETFs and sector ETFs; they carry less single-stock risk (earnings, regulation, M&A), they are highly liquid if you choose your ETF well (meaning you can trade in size from early in premarket all the way to late in postmarket), you can amplify the risk/reward via structure - using the levered ETFs - and best of all you can hedge them so you can play long/short over the timeframe of your choosing, using the inverse and/or inverse levered ETFs.

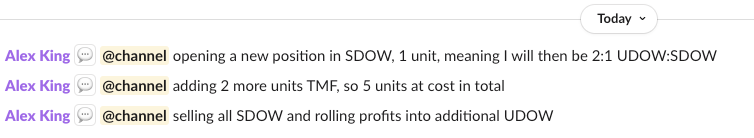

I intend to spend more of 2025 playing long/short index and sector ETFs, and less time playing single-stock names, than I did in 2023-4. Indeed even during the only-up period of the last couple years, index ETFs have been my best performing ideas - because the risk-managed nature of them meant I was happy to own them in large allocations, with levered ETFs, knowing that if things went south I could hedge and if necessary go net short to capture the downside before then switching to the upside. Here’s an example from today in our Inner Circle service.

Whether 2025 will be dominant-long in indices and sectors, or dominant-short, I don’t know. But the beauty of this model is, it doesn’t matter. You can make good money either way if you have freed your mind of any directional thesis and instead just let the market lead your opinion, and if your time is freed up by not trying to manage very large numbers of disparate positions.

So. Happy New Year folks. Let’s go!

Cestrian Capital Research, Inc - 2 January 2025.